The following overview presents a more detailed insight into Ethiopia’s context concerning external debt data spanning the period from 1970 to 2022. Complementing the information in the video are key events that have played pivotal roles in shaping the trajectory of Ethiopia’s overall economy and external loans. These events encompass political, economic, and social dimensions, believed to have directly or indirectly influenced the country’s context in relation to external loans.

The chronological timeline below provides a structured account of these events, offering brief explanations of their impact on the country’s economy and the potential fluctuations in external debt. By examining this timeline, viewers gain insights into the complex interplay of historical occurrences and policy decisions that have contributed to the rise or fall of Ethiopia’s external debt over the years.

First-wave global debt accumulation

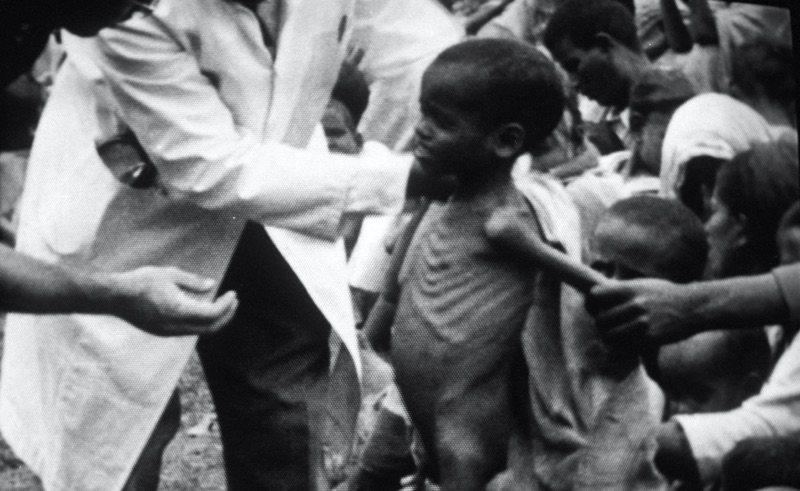

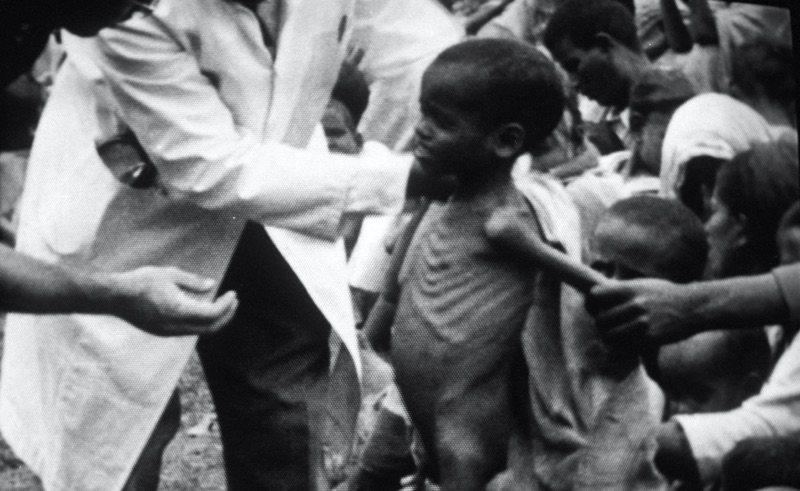

Wollo–Tigray famine

© Express/Getty Images

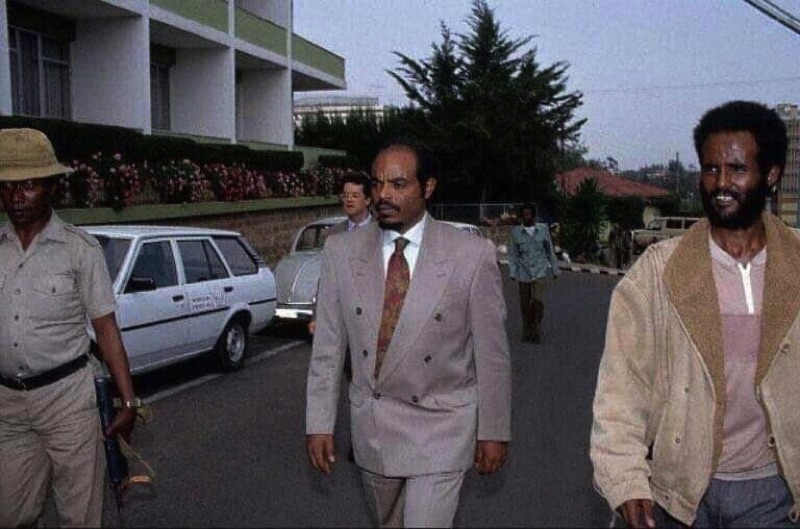

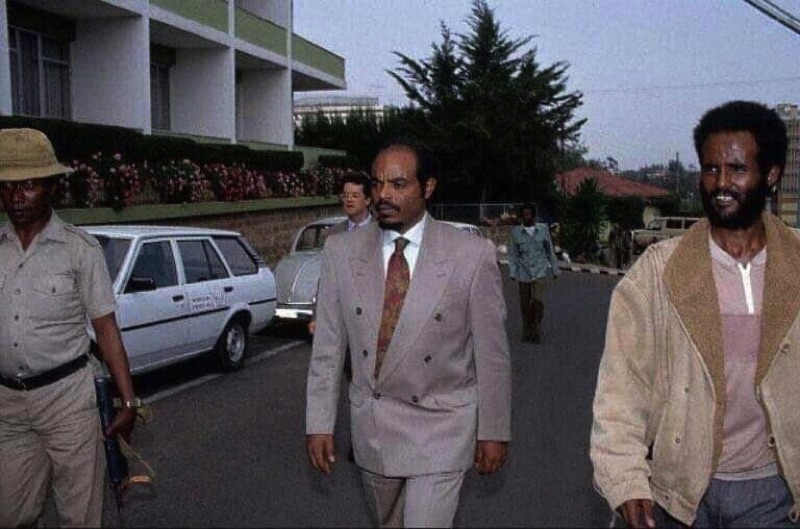

Derg in power; enforced mass-scale nationalization

Ogaden War (Ethio-Somalia War)

GDP hit an all-time low of -11.74%

USSR downfall

EPRDF came to power

Eritrea's independence

Ethio-Eritrea War

© Associated Press/Sami Sallinen

GDP hit an all-time high of 13.57%

The ‘97 election

Ethiopia's debt relief of $2.2B

ZTE's $2B project

© Xinhua Photo

GTP I Launched

Launch of GERD and light rail projects

Passing of PM Meles Zenawi

© Monika Flueckiger/World Economic Forum

GTP II Launched

Addis-Djibouti Railway construction completed

Political reform

© Zacharias Abubeker

China extended $4B debt repayment by 30 years

Launch of Home Grown Economic Reform I

COVID-19

© Xinhua/Michael Tewelde)

The Northern Conflict

© Getty Images

Establishment of Ethiopian Investment Holdings

© Ethiopian Investment Holdings

Launch of the Ten Years Perspective Development Plan

Safaricom's $1.2B initial investment

GDP per capita surpasses $1,000 mark

As illustrated in the timeline above, Ethiopia’s economic context has been significantly influenced by a myriad of factors over the years. Government transitions, shifts in political ideologies, ambitious grand projects, the ravages of war and famine, the unforeseen challenges posed by pandemics, and strategic decisions regarding debt treatment are among the diverse events that have left an indelible mark on the nation’s economic landscape which, undoubtedly, has a reverberating effect on the country’s debt accumulation. These occurrences not only serve as historical markers but also underscore the intricate relationship between geopolitical dynamics and economic realities. It’s important to note that this overview exclusively focuses on external loans, and the broader economic picture is further shaped by the substantial impact of internal loans and advances. Not to mention, while these events undoubtedly influenced the nation’s economic landscape, likely impacting its inclination towards loans, establishing a direct and quantifiable connection between these occurrences is exceedingly challenging. Thus, while this timeline provides valuable insights, it may not capture the entirety of Ethiopia’s economic complexity.

Source: International Debt Statistics Database (World Bank)