It’s Valentine’s Day, and the streets are lined with sellers offering bouquets to hopeful couples. Yet, only a few know just how important the flowers (and subsequently the cut flower industry) are to Ethiopia’s economy. Behind each beautifully arranged bouquet lies a highly strategic sector the country has worked hard to cultivate.

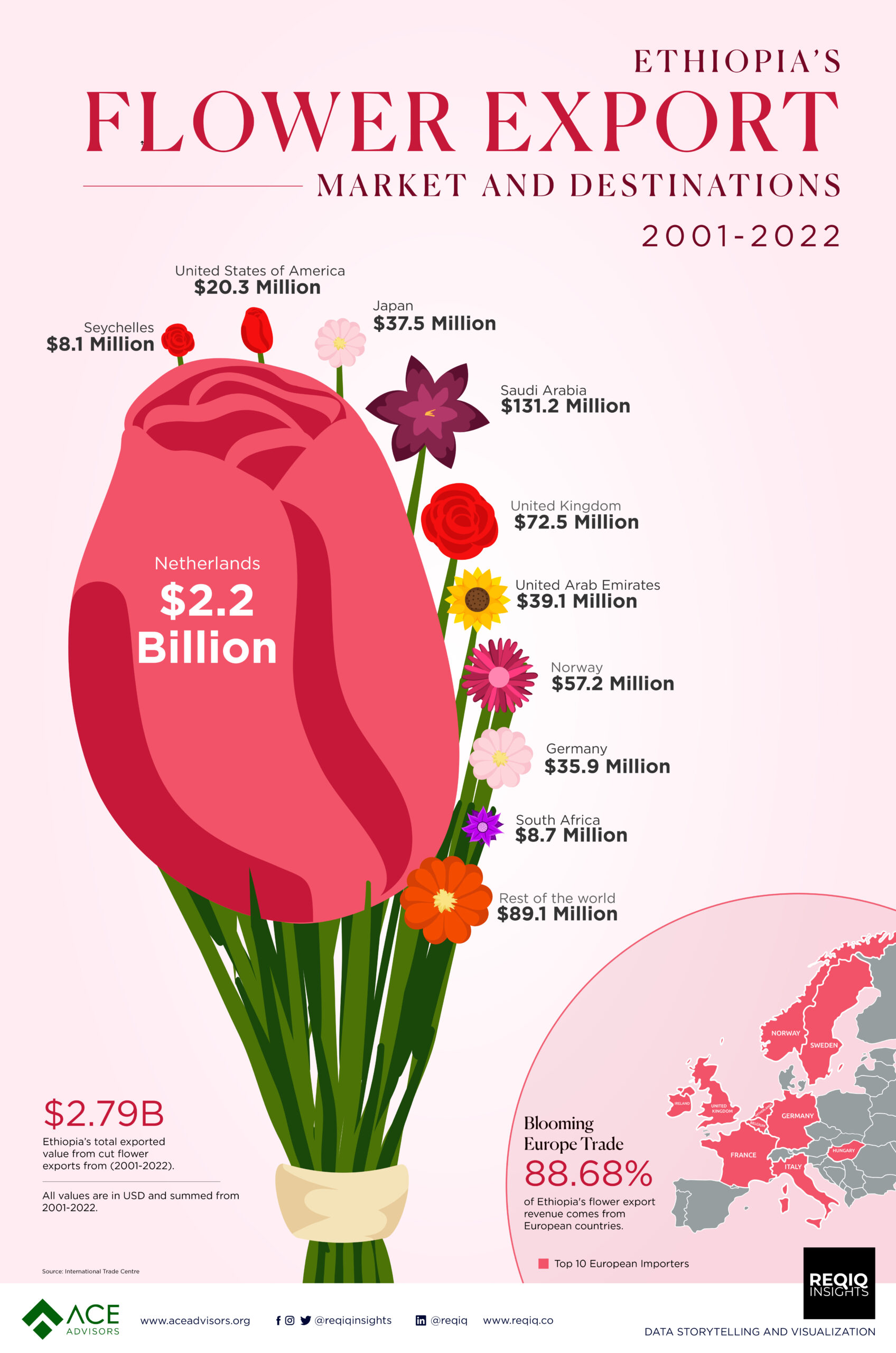

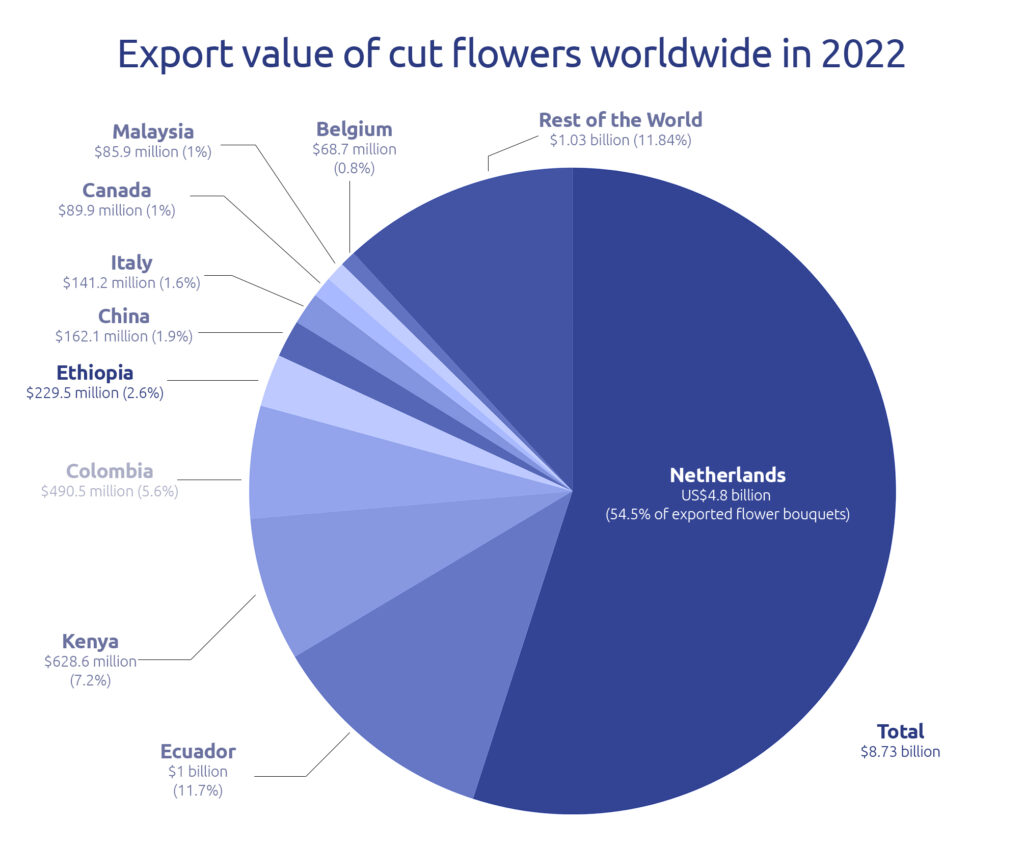

The cut flower exporting industry is highly concentrated, with only a few countries dominating the sector. Among these, an even smaller group claims the top spots. The Netherlands is the biggest exporter of flowers in the world, with exports worth $5.7 billion in 2021. On the other hand, Canada ranks tenth and its flower exports are only worth $82 million, indicating a huge difference between the top and the bottom of the list.

Although Ethiopia is often considered the fifth largest flower exporter, at least by various online sources, this ranking is misleading as these export figures are significantly lower than those countries peering the country on the list. The gap between Ethiopia’s exports and Kenya’s, which is in fourth place, is much larger than the gap between Ethiopia and Belgium, which is in sixth place. Simply ranking countries by their export figures doesn’t accurately portray the significant variation between them in the global cut flower trade, which is highly stratified.

Source: https://www.worldstopexports.com/flower-bouquet-exports-country/

The data presented makes abundantly clear the vast difference in export size between Ethiopia and the top cut flower exporting nations. Compared to global heavyweights like the Netherlands, Colombia, Ecuador, and Kenya, Ethiopia’s shipments have a long way to go.

Cognizant of this, the Ethiopian government has already mapped this road ahead in the Ten-Year Development Plan. It has set a goal to ”…raise foreign currency earnings from the export of horticulture products from USD 326.1 million to USD 950 million,” at least 90% of which is expected to be generated by the floriculture sub-sector.

There is a persuasive rationale behind this lofty expectation of floriculture to generate export revenue. It comes from the remarkably rapid rise of the cut flower industry within Ethiopia’s economy in a short span.

The History Behind Ethiopian Flowers

Ethiopia is a country with optimal climate conditions for growing flowers. That being said, while flower farming has existed in Ethiopia for some time, it was not until foreign investment arrived in the early 2000s that the sector truly began to develop and thrive. Historical records show only two locally-owned flower farms operating prior to 1997, both on a small scale and for just a few years. 1

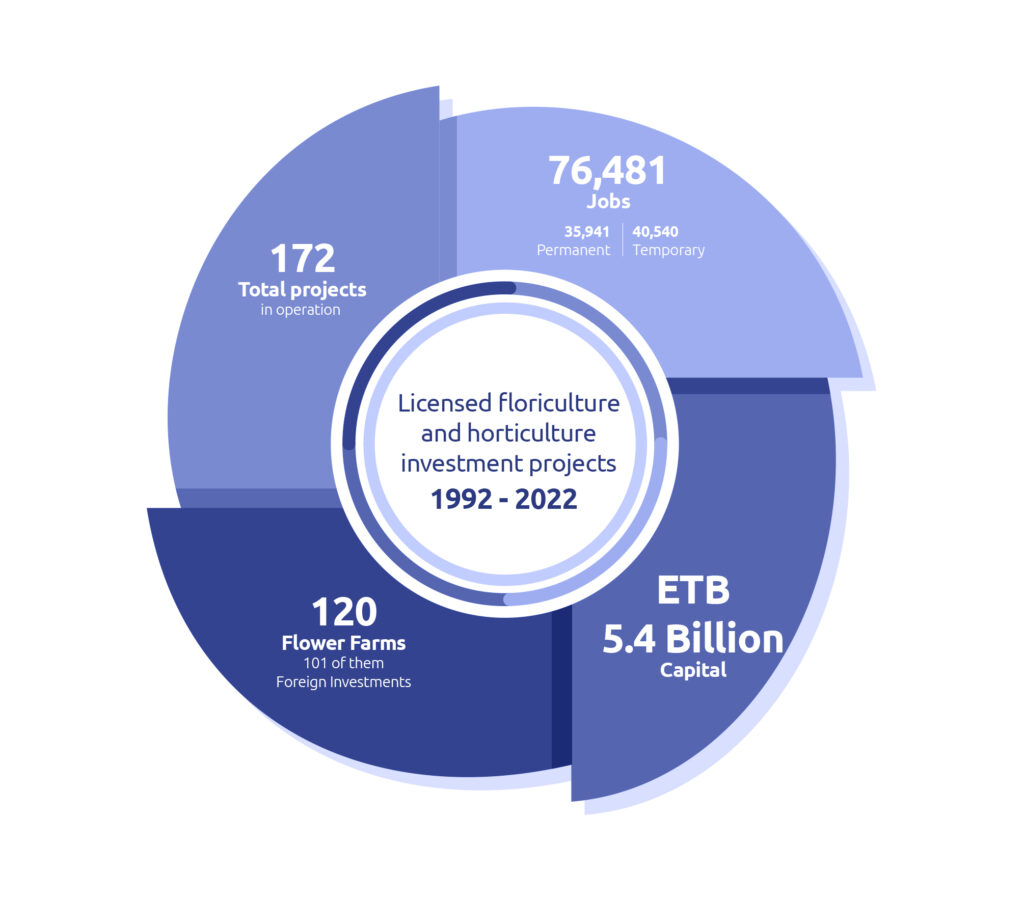

The entrance of foreign capital marked a turning point. Ethio Dream Flower PLC and Golden Rose Agrofarms Ltd., established in 1997, became the first foreign-owned flower operations in Ethiopia and are still active today.1 In the period since, over 120 commercial flower farms have commenced business across the country.

Source: The Ethiopian Investment Commission (EIC)

Foreign investment fueled the growth of a new industry in Ethiopia, transforming the floriculture sub-sector into a robust contributor to the economy. The flower farming industry has expanded significantly since its inception in the late 20th century.

Integral to the cut flower industry’s rapid ascent has been strong governmental backing. Ethiopia’s Plan for Accelerated and Sustained Development to End Poverty (PASDEP), laid out in 2004, underscored flower farming’s meaningful role in export earnings. The PASDEP prioritized robust support for the industry’s swift expansion1, with Ethiopia’s Growth and Transformation Plan I and II following in its footsteps.

This support materialized through generous incentives. Farms received a five-year tax exemption along with duty-free import of machinery. Access to affordable bank loans and farmland-fueled operations. A full exemption on export customs duties further strengthened competitiveness in foreign markets2.

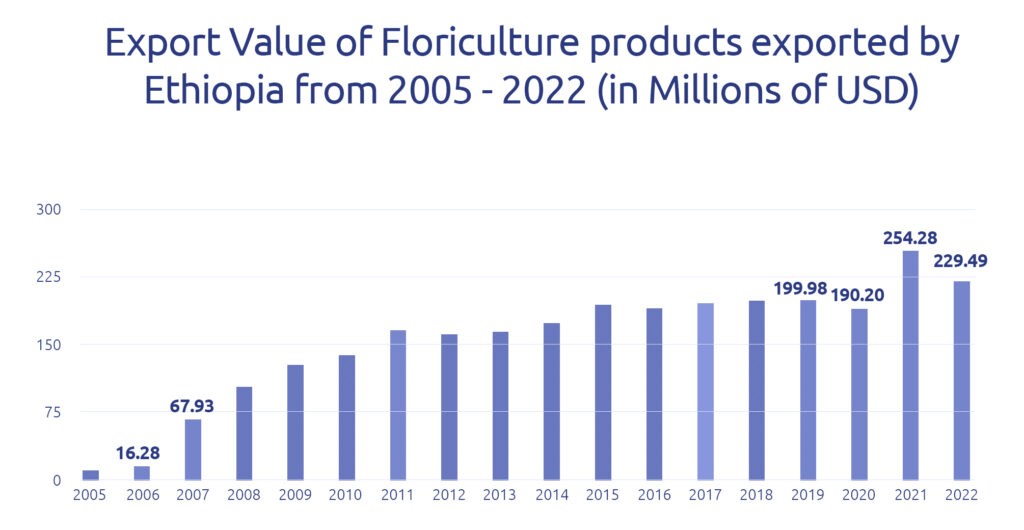

Source: https://www.trademap.org/

Data reveals that 2007 marked the year Ethiopia’s flower exports truly took off, with a generally steady upward trend observed until 2020. Perhaps surprisingly, exports were only minimally impacted by the COVID-19 pandemic (4.9%), followed by a significant rise (33.8%) in the subsequent year. This contrasts with other major exporters, such as Colombia, which saw flower sales plummet 40% in the second quarter of 2020 alone3.

Ethiopia’s minimal effect and sudden rebound can be explained by a lack of lockdowns during the pandemic, fewer business disruptions, and limited change. Meanwhile, the top four countries experienced decreases due to COVID-19, opening an opportunity for Ethiopia to help fill the sales gap in 2021 and achieve huge export growth. However, this rise proved short-lived as values receded again by 9.8% in 2022 amid domestic unrest and recovering flower shipments from rival nations overcoming the pandemic’s impacts.

The fluctuations in Ethiopia’s flower exports show that stability in this sector has yet to be established. Despite the recent flower farm burnings due to internal disputes that underscore the need for enhanced protection, Ethiopia has vast untapped potential for higher yields and global sales and must optimize resource usage through efficient planning by authorities. Only by maximizing productive capability can it cement top exporter status. The slow trajectory implies significant effort is still required to achieve the aspiration of a top-five ranking. Ethiopia’s flower industry enjoys bursts of growth, but lasting success demands consistency built on sound, long-term strategies that integrate the welfare and adequate payment of domestic laborers.

- Labour Agency In The Cut Flower Industry In Ethiopia: Should I Stay Or Should I Go?, Lotte Staelens

↩︎ - Prospects and challenges of floriculture industry in the context of agricultural transformation in Africa: Evidence from Ethiopia. ECA. Belay Tizazu Mengiste (2016) ↩︎

- Competitive Performance of the Ethiopian Flower Industry from a Pre-to Post COVID-19 Pandemic Era (2003-2022): A Comparative Study. Muluken Ayalew Worku, et al. ↩︎