Seeing long queues for taxis or buses is nothing new in Addis Ababa. For many years, the respite from these was the Lada—the product of Derg’s alliance with the Soviets, individually owned and operated, and entirely unregulated, compact sedans whose driver determined the price of the ride. Since then, there have been many solutions, some more effective than others, including the light rail system and Lada-turned-ride-share system for short-distance transportation.

Transportation has been a pain point for Addis Ababa for many decades, and the boom in industrialization, steady migration to city centers, and new developments and settlements in our recent history have only exacerbated this challenge. Add to this the limited and poorly maintained road networks that are not keeping up with the times, and you start to get a sense of the gravity of the challenge. Leaving these challenges to simmer for decades creates a cascading effect.

The transport headaches of Ethiopians include transportation shortages, low hospitality (particularly for urban and foreign tourists) from fellow passengers and drivers, fuel shortages, and the high price tag on car maintenance and accessories, which indirectly affects prices and road safety. These issues need to be addressed by regulating and monitoring bodies. However, these government bodies also have big-picture concerns of their own, such as addressing the growing fuel demand, building accessible roads, and minimizing CO2 emissions by taking old cars off the streets.

Road transport is the predominant mode of transport and has a share of over 95% in freight and passenger movement in Ethiopia. It is estimated that the vehicle population has exceeded 1.2 million. Addis Ababa alone houses 56%, or 630,440 vehicles, steadily growing by about 10% annually. Most of the vehicles are older than 15 years and beyond their useful and safe service life. As a result, high fuel consumption, pollutant emissions, and road accidents prevail.

The rising challenges and, with them, the rising need for efficient transportation, buoyed by exponentially improving telecom services, were the stage on which ride-hailing apps emerged.

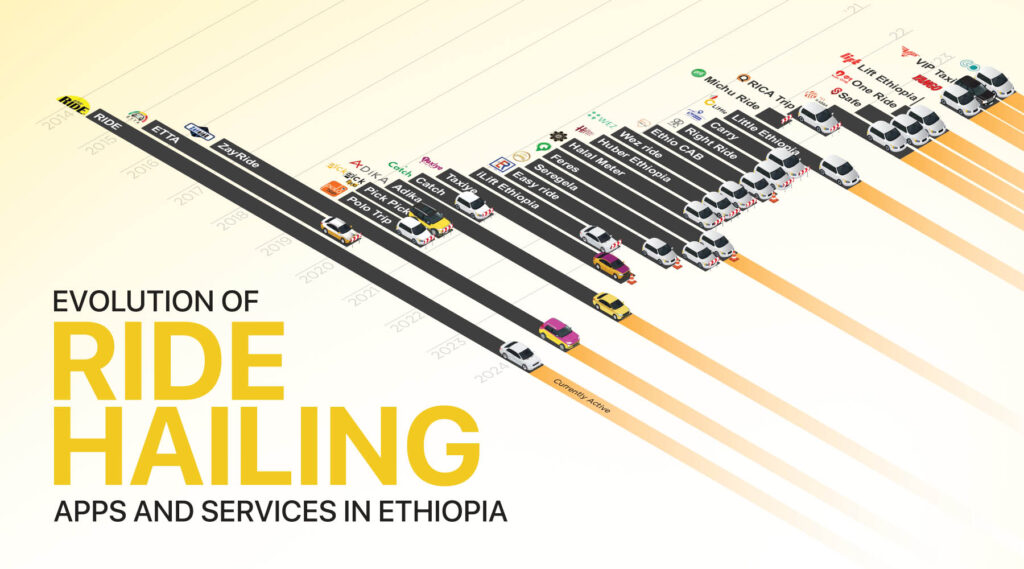

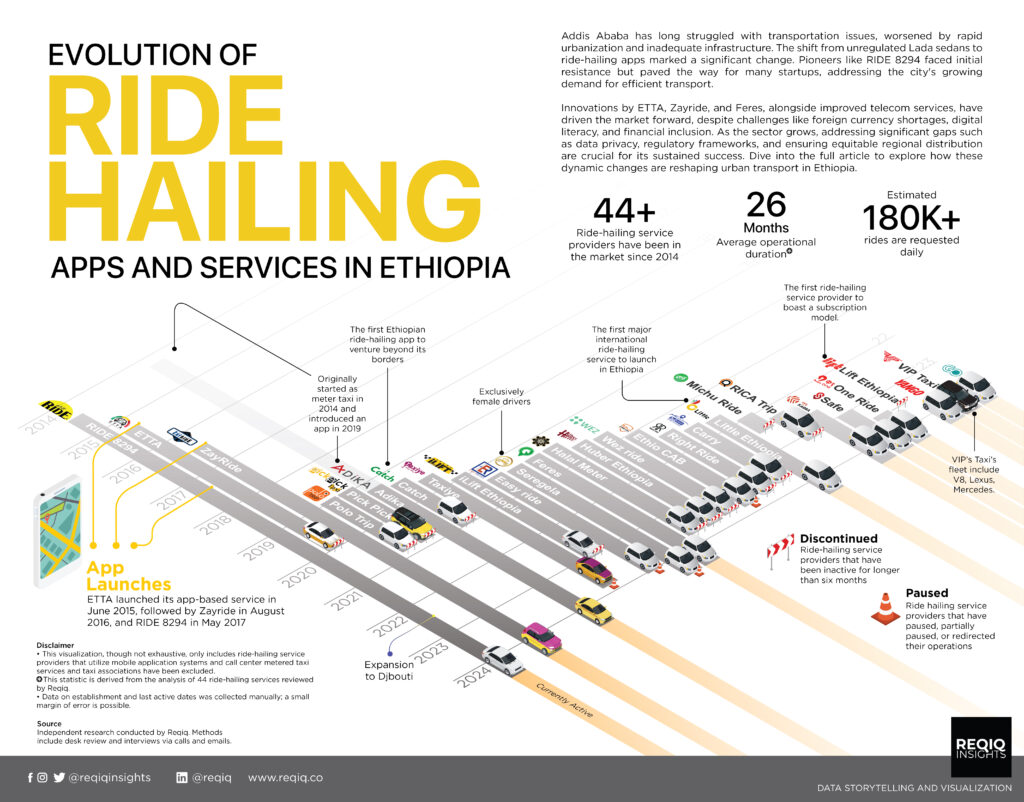

The Pioneers and the Trendsetters

Established in 1997, Adika Tour, Travel, & Car Rental led Ethiopia’s car rental industry. In 2014, leveraging their international experience, they launched ‘Adika Meter Taxi’ as a pilot project, repurposing imported vehicles. This initiative marked a pioneering moment in Ethiopian transportation. The concept of a meter taxi was quite fresh to the Ethiopian masses. The facts matched Adika’s lukewarm approach to the pilot— Adika already had a thriving business model without the hassle of introducing and managing a new way of doing things through the pilot.

In the same year, RIDE 8294 began its journey as a ride-hailing service with a modest setup comprising an SMS and call center. Breaking into the market was a formidable challenge, as Samrawit Fikru, CEO of Hybrid Designs, recounts in various interviews. The hurdles included navigating government roadblocks and policies (or lack thereof), recruiting and sustaining drivers, creating and sustaining a market, and continuously refining the system to ensure smooth operations.

The operating environment was challenging and, at times, hostile. Not long ago, code-one operators (the plate tags provided to public transport service providers, including Lada operators) blocked RIDE 8294 vehicles, damaged property, and even assaulted drivers. The claim? “They [RIDE drivers] took our living.” Instead of allowing competition, there was an uproar about the injection of RIDE 8294 drivers onto the streets of Addis, to which regulating bodies, for a brief window, yielded.

Despite recognizing that this innovative solution could mitigate transportation shortages, the government initially treated RIDE 8294 more like a foe than a friend, even briefly halting their operations with the dreaded ‘ታሽጓል’ tape. However, it became irrefutably clear that the company held immense potential to create jobs, generate tax revenue, enhance business competition, improve transport service quality, and meet growing demand. Consequently, the government reissued permits with new guidelines and legal amendments, allowing RIDE 8294 to resume operations.

These are just some of the problematic contexts Samrawit of RIDE 8294 had to traverse to get the sector to where it is today. It is a testament to her innovative tenacity that all ride-hailing apps are collectively, albeit informally, referred to as ‘Ride.’

The foundational challenges that found solutions by or through RIDE 8294 inspired many young entrepreneurs to enter the market— catalyzing the emergence of up to 30 similar service providers in close succession, according to our research— despite the presence of global giants like Uber and Bolt in neighboring Kenya.

The Game Changers: ETTA and Zayride

ETTA and Zayride entered the market with a revolutionary approach: mobile apps. ETTA launched nine months after RIDE 8294, introducing a mobile app in 2015 that tested Ethiopia’s digital literacy and adaptability. Zayride followed with its app in 2016, and RIDE 8294 with its app in 2017.

Despite the challenges, this innovation pushed some customers out of their comfort zones, transitioning from call centers to mobile apps. Financial inclusion and smartphone affordability remained barriers, but the market slowly adapted.

Ethio Telecom’s efforts to lower prices, enhance communication infrastructure, and promote internet usage facilitated the adoption of smartphones and tech-based businesses. This shift positively impacted not only ride-hailing but also fintech, food delivery, e-learning, super apps, betting, and other tech-based products.

During the COVID-19 pandemic, Feres disrupted the market with innovative strategies: zero commission, mileage collection, airtime gifts, prizes, and discounts. Entering the market with a significant incentive to both drivers and passengers was the first indication of a market sensing saturation. Its user-friendly mobile apps, designed with an understanding of Ethiopian consumer psychology, attracted both drivers and users, eventually making it a market giant despite its late entry.

Ethiopia’s platform-based gig economy is flourishing, driven by improved internet access, urbanization, high youth employment, and global trends. Ride-hailing platforms have popularized the gig economy model, playing a significant role in this transformation.

The digitalization of transport payments is also gaining momentum. Telebirr partnered with RIDE 8294 in 2022 to enable mobile money payments, while E-Birr collaborates with Feres for similar services. These integrations and partnerships that allow for cashless transactions are further establishing ride-hailing services as the safer, more convenient option.

Hail the Full-Fledged Ride-Hailing Market in Ethiopia

Based on our findings, the active regional ride-hailing service provider is Easy Ride, which operates in Jijiga and the Somali Region. Feres, RIDE 8294, Zayride, and others also claim to provide out-of-Addis transportation, but this comes with many challenges and limitations. Safety, willingness of drivers, and the relatively low demand for return trips make this an undesirable challenge for ride service providers to solve. It is challenging to confirm or refute that ride-hailing service providers operate outside Addis Ababa, but our research points to nearly 99% of the market being concentrated in the capital.

This shows that the growth is not distributed fairly throughout the regions, even though areas such as Somali, Bahir Dar, Adama, and Hawassa are considered highly adaptive for tech-based solutions and have the same growth-related transportation challenges Addis was/is facing.

The revenue in Ethiopia’s ride-hailing market is projected to reach USD 254.40 million by the end of 2024. With a yearly growth rate of 20.73%, the Ethiopian ride-hailing market volume is expected to reach USD 540.50 million by 2028. This projection hinges on factors like urban population growth, increased internet penetration, and a wider range of coverage. Ethio Telecom says it has reached the capacity to handle 90 million users in connectivity combined with its competitor, Safaricom, marking that internet coverage won’t be a headache in Ethiopia’s future. By 2028, the number of users in this market is expected to reach 16.5 million.

Ride-hailing services now overtly or covertly appeal to various demographic groups as a form of differentiation in a saturating market. Does this actually serve a larger purpose outside of reinforcing divisive rhetoric? Time will tell. However, certain specialties, such as Sergela’s women-only drivers (before the company abandoned this cause recently) and the pan-African Little Car’s focus on corporate clients and experience, are worth celebrating.

The untapped market—yes, with its many challenges—lies outside of Addis Ababa, with uncrowded and newer roads, more versatile vehicles like the three-wheel Bajaj, and relatively lower operational costs compared to the capital.

One-Way Ticket to Bankruptcy

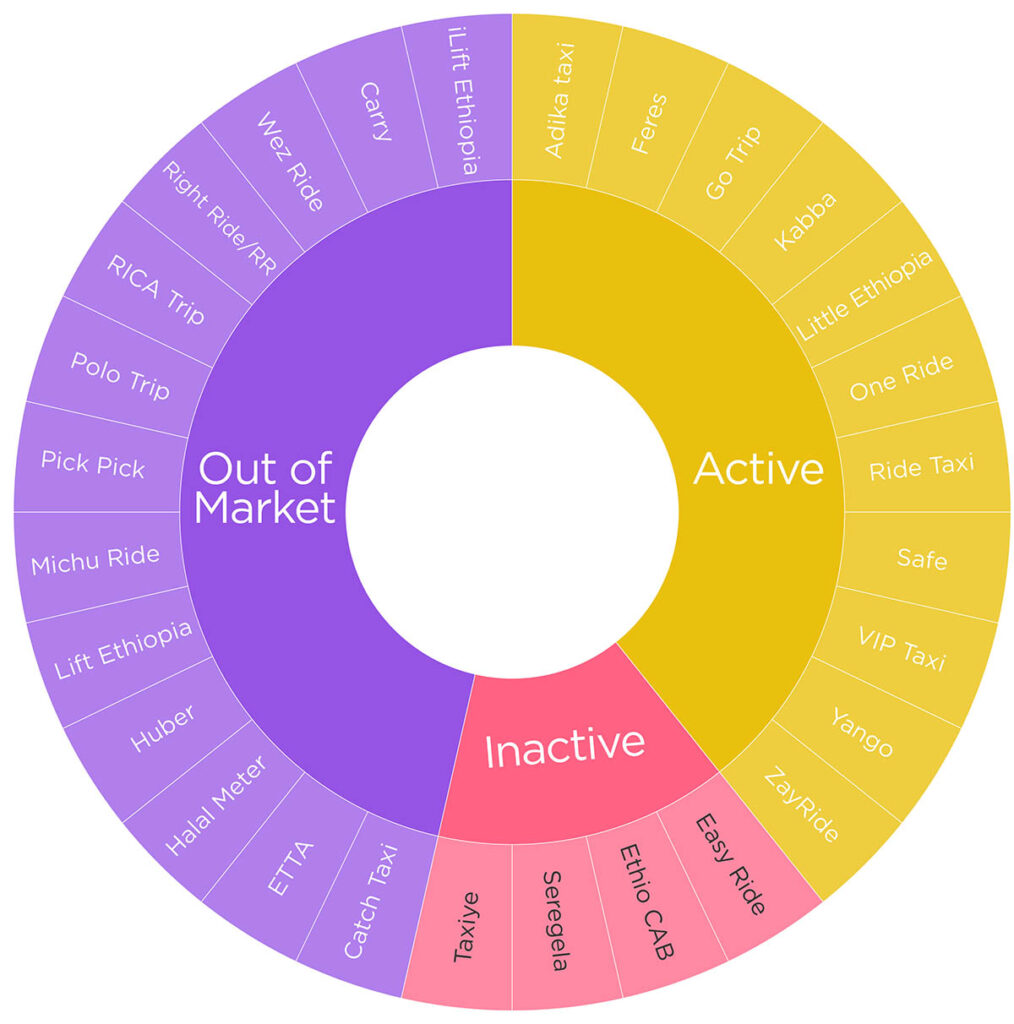

Currently, of the 44 ride-hailing companies whose operation we have reviewed, only 25% are active, 9% have been inactive for the past three to six months through their respective apps, call centers, and direct updates on their respective platforms, and nearly 66% have left the market.

In the race to capture an untapped market and turn profits, numerous ride-hailing companies enthusiastically entered the scene, only to end up bankrupt or barely making ends meet. An astonishing 50% of these ventures have exited the market. Among them, Pick Pick, once the talk of the town, made the wise decision to cease its services, unlike others that silently vanished seemingly into thin air.

For instance, Catch Taxi announced its departure from the Kenyan market but failed to extend the same courtesy to Ethiopian consumers. This culture of secrecy— from defunct ride-hailing services and other businesses— makes it challenging for new and aspiring companies to learn from past mistakes, navigate obstacles, and foster innovation.

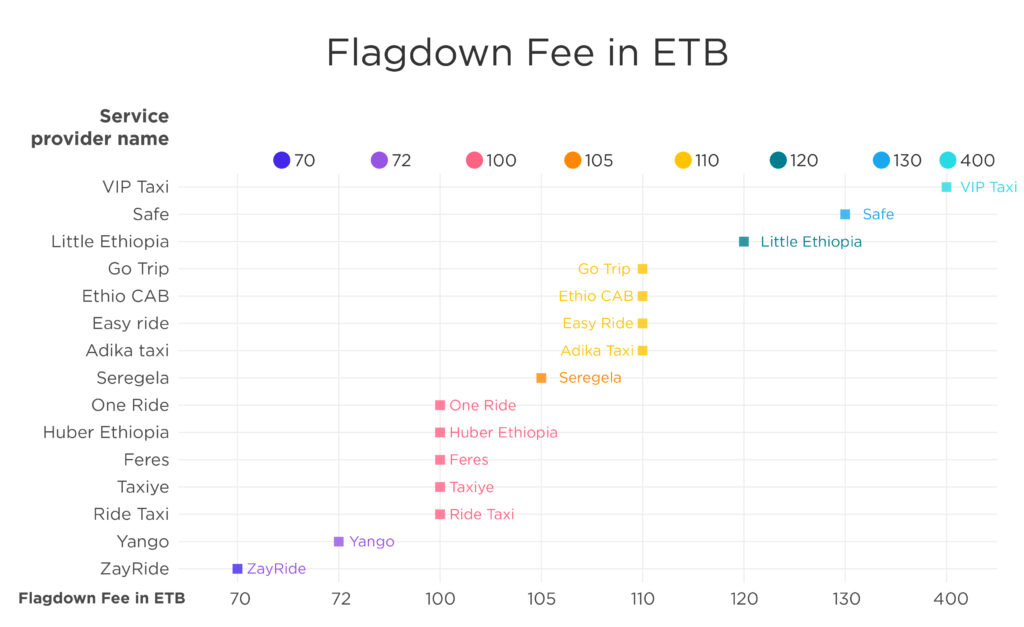

One primary reason for many ride-hailing companies’ failure is the hefty foreign currency needs. To give this context, we have to go back to the beginning—how ride-hailing apps are typically built. Ride-hailing apps are not—typically—developed in-house. They are often purchased from companies such as Onde, which charges in foreign currency and are then integrated with third-party services like Google Maps, SaaS services, and cloud infrastructures, all paid in foreign currency. The cost of Google Maps API, for example, accumulates to a significant fee because it’s billed per request and occurs at least four times per single trip. This cost escalates when you consider the services that access it within a live feed. With the addition of foreign currency access issues in Ethiopia, it becomes harder for service providers to contain these costs while remaining competitive. There are alternatives, of course. Take Yango, for example. It’s a standalone franchise brand that owns the app infrastructure, mapping system, and routing algorithm— making it entirely independent— which may explain its relatively lower base tariff.

Amid these difficulties, failing to meet drivers’ and consumers’ expectations can lead to a sudden loss of market share, compelling a company to sell its vehicles and quit the game. In summary, the absence of both human and financial capital may result in companies choosing the easy way out.

The financial challenges are not single-source. Other factors such as poor marketing strategies, targeting the wrong consumer base, inadequate system design, unclear value propositions, lack of differentiation, external crises like COVID-19, and internal organizational instabilities have contributed to setbacks for many, and to some, these setbacks have taken their last gasp of air.

Navigating Data Safety

Some concerns center around one of the more popular system-as-a-service (SaaS) providers, Onde, on which most Ethiopian ride-hailing service apps are based or developed at.

Onde, based in Estonia, is a technology company specializing in providing white-label ride-hailing and taxi management solutions. Their platform enables businesses to launch their own branded mobile applications for ride-hailing services, helping them compete with global giants like Uber and Lyft. In Ethiopia, Onde’s clients include RIDE 8294, Seregela, and others, all of which leverage Onde’s platform to streamline operations, enhance customer experiences, and expand their market reach. These partnerships signify Onde’s growing influence in the Ethiopian transportation sector, but not without concerns.

When addressing user data privacy, companies like Onde must ensure that users are fully aware of any data-sharing practices with third parties. This awareness must be embedded in the terms and conditions that users agree to, clearly articulated in local and state languages such as Amharic, Oromifa, Tigrigna, and others. This information should be presented upfront and transparently, ensuring that all users, regardless of their language preference, understand how their data may be used and shared. Given the newness of these services, and the overall state of lack regarding digital literacy, one would even venture that these service providers bear the burden of having to go above and beyond to educate their stakeholders.

The recent incident involving RIDE 8294 drivers/passengers finding their data registered on the Seregela platform without their consent highlights the pressing need for robust data protection measures. This breach suggests either unauthorized access to a shared database or the use of similar central systems by both companies, implicating Onde in questionable data privacy practices and the respective ride-hailing service providers of negligence at best and exploitation at worst.

In Ethiopia, the government is in the process of formulating a personal data protection law designed to safeguard citizens’ privacy and regulate data handling practices. While this legislative framework aims to cover and protect against unauthorized data sharing, its effectiveness will largely depend on how well it is implemented and practiced by companies operating within the country. There is a legitimate concern that international companies, including Onde, may only fully comply with local laws if stringent enforcement mechanisms are implemented.

In conclusion, the ride-hailing market in Ethiopia represents a dynamic and rapidly evolving sector that has the potential to transform urban transportation and drive economic growth. Despite significant challenges, including regulatory hurdles, technological barriers, and financial constraints, the sector has seen remarkable innovations and resilience from local entrepreneurs. As internet penetration improves and digital literacy increases, the market is poised for substantial growth, potentially extending beyond Addis Ababa to other regions. To fully realize this potential, stakeholders must address data privacy concerns, enhance regulatory frameworks, attain socio-political stability, and ensure equitable growth across the country. By doing so, Ethiopia can truly enjoy the full benefits of ride-hailing services, creating a more efficient, accessible, and sustainable transportation system for all.