For any country, the national budget is more than just a financial plan; it is a strategic tool for setting national direction, aligning policy frameworks, and meeting priorities. While the government formulates the budget, its impact permeates every aspect of society, warranting careful scrutiny and thoughtful consideration.

The size and allocation of a budget reflect the government’s economic role. In state-led economies like Ethiopia’s, heavy investment in infrastructure and essential services is expected. This contrasts with minimal state economies, such as the US, Singapore, or Switzerland, where the focus is on protecting individuals and property and enforcing contracts.

A government’s budget underpins economic stability and growth. By prioritizing investments, it can support underprivileged populations, reduce disparities, and ensure financial inclusion. The budget also encourages savings and investments through tax regulation and supports public sector enterprises in creating jobs and generating revenue.

This article delves into Ethiopia’s 2017 (2024/25) national fiscal budget, the context in which it is being dispensed, and what it means for the Ethiopian people.

Ethiopia’s Economic Context

Ethiopia, despite lofty ambitions for economic stability and growth, has faced formidable challenges recently. Setbacks such as COVID-19, the Russia-Ukraine war, Red Sea security concerns, regional conflicts, humanitarian crises, piling debt, and unusual and extreme weather events have compounded a complex economic landscape marked by high inflation, chronic foreign currency shortages, significant humanitarian needs, and intense domestic and foreign debt pressure. Despite this backdrop, the Ethiopian government remains optimistic about economic prospects, projecting a growth rate of 8.4% in the upcoming fiscal year.

In a recent parliamentary speech, His Excellency Ahmed Shide, Minister of Finance, acknowledged the country’s fiscal challenges, including high inflation, the rising cost of imports, a shortage of foreign currency, mounting debt, and insufficient public revenue to meet the government’s ambitious development goals. To address these issues, the government has implemented, among other efforts, the Medium-Term Revenue Strategy, which includes tax policy reforms such as the excise tax collection stamp system and value-added tax on additional goods and services.

It is easy to deduce that the reliance on a narrow tax base makes government revenue highly vulnerable to economic fluctuations. The Ethiopian government is working hard to widen the tax base while also resorting to a common tactic of imposing heavier taxes on the small, relatively wealthier segment of the population to generate the necessary revenue. This approach, driven by the need to fund essential public services and infrastructure, can lead to several consequences, of which Ethiopia is getting its fair share. It risks overburdening the relatively wealthier individuals and businesses, stifling economic growth, and discouraging an enabling business and investment climate.

Allocation Logic: Economic Impact and Challenges

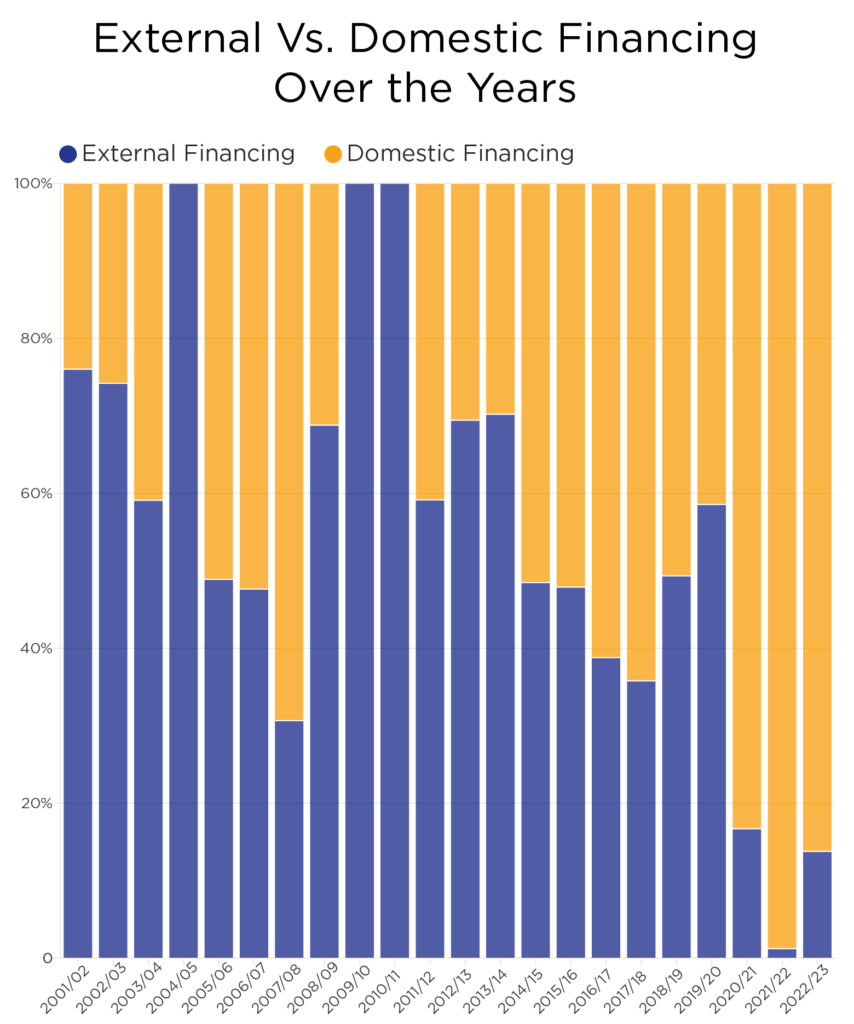

The government relies on a mix of domestic and external sources, with domestic revenue bolstered by tax reforms aimed at increasing efficiency and broadening the tax base. Significant contributions are expected from state-owned enterprises and fees. External revenue, comprising foreign aid, grants, and loans, remains vital, with international partners supporting various developmental projects.

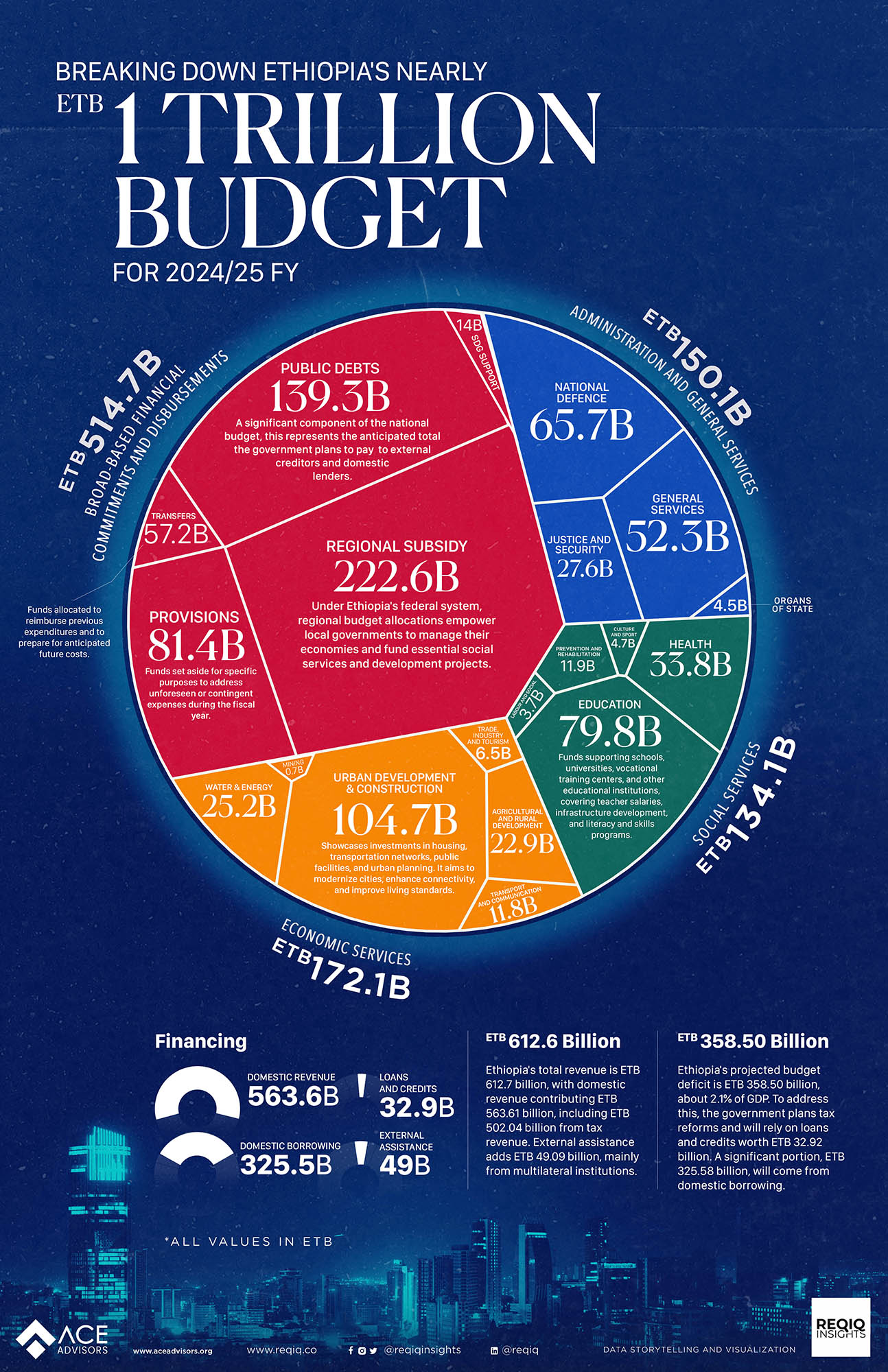

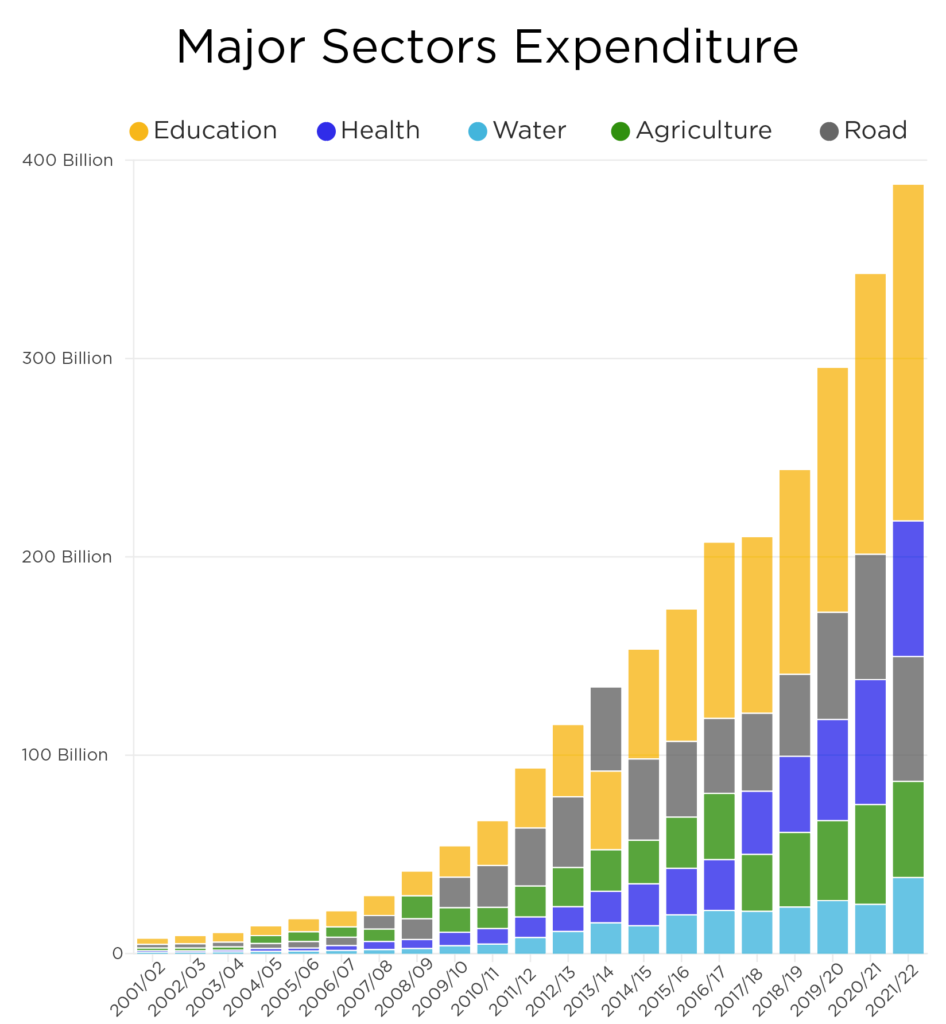

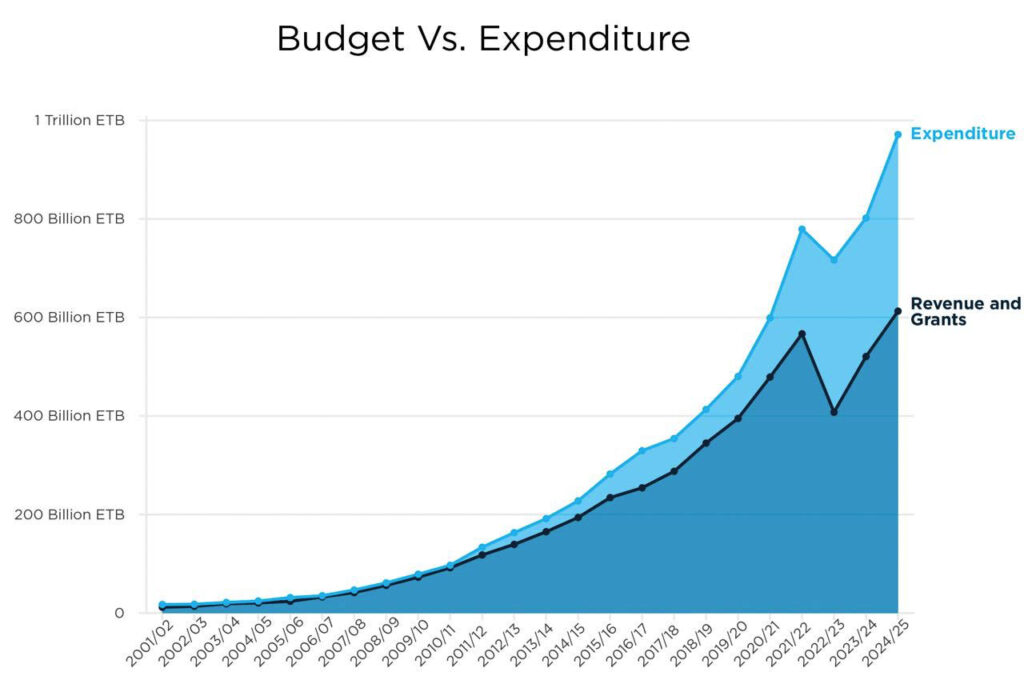

The budget underscores the government’s commitment to economic growth, social service enhancement, and infrastructure development. The budget, totaling ETB 971.2 billion, marks a significant increase from the previous year and sets a new record for the nation. Key priorities include investments in industrial parks, agricultural modernization, and small and medium enterprises (SMEs) to boost economic growth. Additionally, there is increased funding for health and education aimed at improving access and quality. Major projects in transportation, energy, and telecommunications highlight the focus on infrastructure development. Furthermore, a significant allocation has been made to ensure national security and stability. However, the reduction in capital expenditures raises concerns about the budget’s long-term sustainability and its effectiveness in stimulating economic growth.

The budget’s impact on Ethiopia’s economy is multifaceted. It aims to stimulate economic growth, improve social services, and develop infrastructure while facing significant challenges such as high inflation, a narrow tax base, and substantial debt.

Currently hovering around 23%, inflation remains a significant concern. The budget addresses this through controlled spending and monetary policies aimed at managing inflationary pressures. Additionally, the Ministry of Planning has proposed rebasing the Consumer Price Index (CPI) to better reflect current economic conditions. The CPI measures the average change in prices over time that consumers pay for a basket of goods and services. Rebasing ensures that the CPI accurately represents changes in consumption patterns, prices, and the economy, although it may introduce selection bias and short-term data distortions.

Debt servicing, a central concern for the government, accounts for ETB 139.31 billion of the budget, constraining its ability to finance essential services and infrastructure projects. If the government decides to float the Birr to placate the IMF, it could increase foreign debt servicing costs, further straining the budget and diverting funds from critical services like education and healthcare. Moreover, in a fashion reminiscent of South Sudan, currency volatility could deplete foreign exchange reserves, necessitating central bank intervention, potentially leading to hyperinflation, increased living costs, public discontent, and social unrest, challenging political stability. The government, alternatively, may choose to devalue the Birr as has been suggested by the IMF previously, and that, too, comes with its pandora’s box of consequences. On the one hand, this measure could enhance exports, reduce the trade deficit, and stimulate local production. However, it is equally plausible that it could lead to higher inflation, an increased debt burden, capital flight, and social unrest.

In his address to Parliament, His Excellency Prime Minister Dr. Abiy Ahmed stated that the negotiations with the IMF have been ongoing for more than five years but are now nearing a conclusion. He highlighted that if the negotiations are successfully finalized and the proposed reforms are implemented, Ethiopia stands to receive an injection of USD 10.5 billion. The Prime Minister also emphasized that the current budget is structured to cover the nation’s basic needs and may be subject to revision should the context change.

How Did We Get Here?

Although it might sound shocking to hear we’ve crossed over into the trillions, the reality is that the 2017 fiscal budget registers only modest real growth, and here’s why:

Ethiopia’s economy, with an average annual trade deficit of $14 billion, is heavily dependent on global markets. This dependency imports inflation through goods and services, making inflation control and currency strength critical factors. According to His Excellency Ahmed Shide, Minister of Finance, neither of these factors has been a particular strength for Ethiopia, as the government has struggled to reduce inflation to single digits as planned, and the parallel market remains uncontrollable.

To account for inflation and currency exchange rates, the GDP deflator and historical exchange rates provide a clearer picture than nominal values alone. The GDP deflator measures price inflation within the economy, reflecting changes in the price levels of all goods and services produced. For instance, inflation rates were 20.2% in 2014, 34% in 2015, 29.3% in 2016, and projected at 28.8% in 2017, indicating significant inflationary pressures during these years.

Exchange rates, crucial for determining international purchasing power and the real value of revenues and expenditures, showed a depreciating trend for the Ethiopian Birr against the US Dollar. This depreciation implies higher costs for imports and a lower relative value for exports, contributing to the gap between nominal and real values in USD terms.

Adjusting for inflation and using historical exchange rates provides a more accurate assessment of economic performance and budgetary allocations. This methodology ensures that budget analysis reflects true economic conditions by accounting for the erosion of purchasing power due to inflation and the impact of currency depreciation.

Over the past four years, there has been significant growth in tax and non-tax revenues, with nominal increases of 50.33% and 75.5%, respectively. This indicates a strategic shift towards broadening the revenue base and reducing reliance on external funding. The moderate growth in project support, with a 49.02% increase in nominal ETB, suggests sustained but measured investment in specific projects. Overall revenue growth, although positive, is tempered by inflation and forex rate impacts, emphasizing the need for a continued focus on economic stability and effective revenue utilization.

Despite a nominal uptick, the 2017 budget shows only limited real growth, underscoring the heavy toll of inflation and currency depreciation.

Bridging the Gap: Revenue Strategies for Ethiopia’s Budget Deficit

Revenue generation is crucial for bridging Ethiopia’s significant budget deficit, approximately 358.5 billion ETB. The country is projected to generate 563.6 billion ETB in domestic revenue for the next fiscal year, supplemented by 49.1 billion ETB in external assistance. In his speech to Parliament, His Excellency Ahmed Shide, Minister of Finance, emphasized the importance of the Mid-Term Revenue Strategy, a high-level roadmap for tax system reform aimed at widening the tax base and ensuring efficiency and effectiveness in taxation. These measures, combined with prudent fiscal management and targeted investments in key sectors, are crucial for reducing the deficit over time. Although ambitious, by focusing on sustainable economic growth and efficient public expenditure, Ethiopia can mitigate the risks associated with the deficit while working toward a resilient economy.

The budget deficit, representing about 2.1% of Ethiopia’s GDP, indicates that the government’s expenditures surpass its revenues, necessitating borrowing and other financing methods to bridge the gap. While a 2.1% deficit might seem manageable, it is a lesson the nation is learning the hard way about fiscal prudence by stirring clear of unsustainable debt levels. Persistent deficits, if not managed properly, could lead to higher debt servicing costs, reducing funds available for essential public services and investments and potentially creating a vicious economic cycle.

To cover this deficit, the Ethiopian government, besides increasing public revenue, plans to rely significantly on both domestic and external borrowing. The budget details indicate substantial domestic loans amounting to 325.58 billion ETB and external loans totaling 32.92 billion ETB. Domestic borrowing can be more predictable and under the control of national policies, but excessive reliance on it can crowd out private-sector borrowing, potentially stifling economic growth. External loans bring in foreign capital but expose the country to exchange rate risks and the conditions set by international lenders. This dual approach aims to balance immediate financing needs with the long-term goal of maintaining economic stability.

The Budget Versus the Need

Ethiopia’s 2024 Humanitarian Needs Overview reports over 21.4 million people requiring assistance due to conflict, climatic shocks, and socio-economic challenges, highlighting severe deficits in food security, health, nutrition, WASH, and education. The 2017 fiscal budget, while focused on economic growth and social services, allocates substantial funds to debt servicing, limiting resources for humanitarian needs. The budget’s allocations for education, health, agriculture, and infrastructure fall short of addressing the urgent requirements driven by widespread displacement, epidemics, and malnutrition. There is a critical need for increased investments in social protection programs like the PSNP and resilience-building measures to mitigate the impacts of recurring climatic shocks.

On the other hand, the education system in Ethiopia also faces substantial challenges, exacerbated by political instability and ongoing conflicts. Despite increased budget allocations, the real value of education spending has declined due to inflation, and the sector remains underfunded. This has resulted in large class sizes, inadequate resources, and poor learning outcomes. Political instability and conflicts have disrupted millions of children’s access to education, particularly in regions like Amhara, Oromia, and Tigray. The ongoing turmoil threatens to reverse the progress made in improving access to education, particularly for marginalized groups such as girls and children from rural areas.

The nation’s complex economic issues have made these grave concerns but a footnote in the overall concerns of the budget. The 2017 fiscal budget struggles to balance economic growth with the pressing humanitarian and social sector needs. This delicate balancing act again shows the immense challenges Ethiopia faces in creating a budget that can effectively address its multifaceted crises while fostering sustainable development.

Ethiopia’s 2017 budget reflects the government’s efforts to navigate a complex economic landscape and address pressing social and economic challenges. While the budget aims to promote economic growth, enhance social services, and develop infrastructure, it faces significant obstacles such as high inflation, substantial debt, and political instability. Not to mention, to effectively address the humanitarian crisis, Ethiopia must balance its fiscal constraints with the pressing need for enhanced humanitarian and social sector funding.

The effectiveness of the budget in achieving its goals will depend on the government’s ability to implement sustainable fiscal policies, manage debt, address significant humanitarian needs, and address the underlying issues affecting the country’s economy and society.

As Ethiopia moves forward, it is crucial for policymakers, stakeholders, and the public to engage in constructive dialogue and collaboration to ensure that the budget serves as a tool for inclusive growth and development, benefiting all segments of society.

One Response

You understand what the teacher said and I go out with dinner. tin tức e2bet