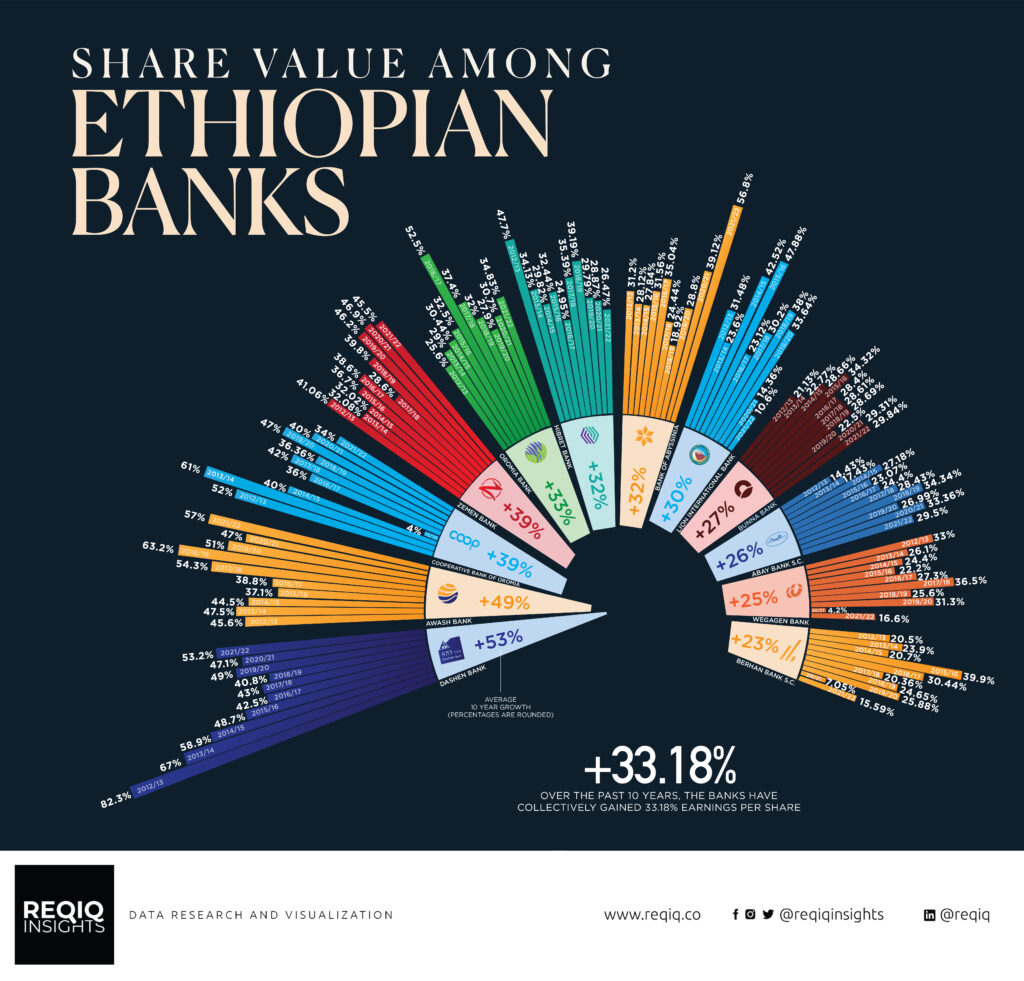

In the vibrant land of Ethiopia, where tradition is working hard to catch up with progress, a peculiar dance unfolds between cash and value. With each passing day, the tides of currency ebb and flow, as the Ethiopian Birr finds itself caught in the intricate web of quickly losing value. Amidst this financial turmoil, a compelling transformation emerges, as the pursuit of stability on an individual level rises, owning property and assets becomes an enchanting endeavor to seize a precious albeit unfortunate situation. One such asset readily available for those eager to put their notes to something but are unready to doll out millions on cars or real estate is purchasing bank shares. With a new bank on the corner every week, purchasing shares is a much less hush-hush investment than it used to be, and has now become part of high-street day to day wheeling and dealing. But before you place your hard-earned cash in the hands of the next bank named after the identity group you most identify with, here is the actual information you need to know.

Demystifying Earnings Per Share (EPS)

EPS is a crucial financial indicator that measures a bank’s profitability by indicating the portion of earnings allocated to each outstanding share of common stock. The calculation involves dividing the bank’s net income by the total number of outstanding shares. This figure represents the earnings generated for each share owned by investors.

Why Do Ethiopian Banks Have Varied EPS Figures?

The EPS figures of Ethiopian banks can fluctuate due to several factors unique to the country’s banking landscape. A bank’s EPS can be influenced by the quality of its loan portfolio. Banks with a lower proportion of non-performing loans are likely to exhibit higher EPS figures, highlighting their ability to manage credit risk effectively. However, despite their ever-growing number, banks in Ethiopia typically avoid risk and lend only to a trusted pool of high-level borrowers.

It also goes without saying that Ethiopia’s economic landscape can significantly impact a bank’s EPS. Factors such as GDP growth, inflation rates, and industry performance can influence a bank’s revenue streams and overall profitability, subsequently affecting its EPS figures.

Interpreting EPS

EPS figures offer valuable insights into a bank’s operations, allowing investors to evaluate its financial performance and investment potential within the Ethiopian context. Here’s what EPS can reveal about an Ethiopian bank:

- Profitability: Higher EPS figures indicate that a bank is generating healthy profits per share. Comparing a bank’s EPS with its industry peers or the market average provides a benchmark for evaluating its profitability.

- Growth Potential: Consistent growth in EPS over time suggests a bank’s ability to expand its earnings and potentially increase shareholder value. However, it’s important to consider the sustainability of this growth and the bank’s strategic positioning within Ethiopia’s banking sector.

- Dividend Capacity: Ethiopian banks with higher EPS figures may possess the capacity to distribute larger dividends to shareholders. For investors seeking income-oriented opportunities, evaluating a bank’s dividend-paying potential is essential.

In conclusion, understanding and analyzing earnings per share is crucial for investors looking to make informed decisions about Ethiopian banks. Fluctuations in EPS, which can be normal within a certain range, can be influenced by factors unique to the country’s banking landscape, such as the quality of loan portfolios and the overall economic conditions. By interpreting EPS figures, investors can assess a bank’s profitability, growth potential, and dividend capacity, providing valuable insights for investment considerations within the Ethiopian context.

Data compiled in collaboration with EthioShareMarket

2 Responses

Keep learning and improving, because knowledge is power. Cá Cược Thể Thao

In our publication, we bring you the freshest updates and entertaining news about the most popular UK stars from the worlds of entertainment, reality TV, and popular culture. Whether you’re a fan of hit reality shows like Love Island, The Only Way Is Essex, or Made in Chelsea, or you’re enthusiastic to track the lives of the UK’s top social media stars, our website covers it all. From juicy behind-the-scenes drama to exclusive discussions, we keep you in the loop with everything happening in the world of your beloved celebrities – https://eventnewslondon.com/vicky-pattison-s-journey-to-happiness-beyond/ .

UK reality TV personalities have gained huge attention over the years, evolving from everyday individuals into household names with massive fanbases. Our blog explores their personal and professional lives, offering perspectives into their latest ventures, friendships, and dramas. Whether it’s a new romance brewing on Love Island or a cast member from Geordie Shore introducing a new business, you’ll find detailed stories that display the glamorous yet sometimes chaotic lives of these stars.